Did You Receive a Notice From The IRS?

You Can Stop IRS Action &

Resolve Your Own Tax Problem... Without Paying a Company $10,000.

Steal the step-by-step system built on decades of high-stakes tax resolution experience. We will show you exactly how to negotiate your resolution, what deadlines matter, and how to regain control of your bank account or your business... in a single day.

Tap into Decades of IRS Negotiation & Tax Knowledge

Instantly access the insider process used by professionals.

Stop guessing and start resolving your own tax problem.

Save $1,500 to $10,000 in Unnecessary Resolution Fees

Why pay a "tax lawyer" for a process you can do yourself? Get your own tax resolution roadmap for less than the cost of one late-fee penalty.

Regain Control, Eliminate Confusion & Sleep Soundly

Take the fear and confusion out of IRS letters. Handle your own tax relief confidently, on your terms, and prevent garnishment & bank levies.

Do your own Self Tax Relief by yourself, but not alone.

That's the exact reason we created the Self Tax Relief Academy.

-

You're worried about a bank account freeze, a wage garnishment, or a business-crushing levy hitting without warning.

-

Threatening IRS letters are piling up, and they read like a foreign language, and you don't know which deadline is real or what they actually want.

-

You've wasted hours searching for answers only to find confusing legal jargon and conflicting advice.

-

You called a tax firm, but their $1,500 to $10,000 fees feel like financial extortion - when you're already struggling.

-

Penalties and interest are snowballing every month you wait, and you desperately want to stop the bleeding.

The Worst Part: You want to fix this, but you're paralyzed by the fear of making a mistake.

If this stress sounds familiar, you're exactly where you need to be.

What if IRS tax resolution was clear and easy enough for anyone to handle themselves in one day?

Stop the PenaltiesHow the Academy Works

After two decades of resolving IRS issues for taxpayers, we discovered something important:

People don’t fail because the tax relief is complicated...

It's just they don't know the process.

So we built the Self Tax Relief Framework™ — A simple, repeatable, 5-step system that helps you:

01.

Identify Your Exact IRS Problem

Most business owners misdiagnose their issue, which leads to wasted time and extra penalties.

02.

Understand the IRS Tax Resolution Path

There are only a handful of relief options. You'll learn which one fits your specific situation.

03.

Gather the Required Documentation

So you never get stuck or blindsided by a request you weren't prepared for.ituation.

04.

Execute Your Tax Resolution Strategy

Step-by-step instructions to communicate, respond, and resolve properly.

05.

Prevent Future Tax Problems

Simple practices that will keep you compliant and protected moving forward.

Introducing The Self Tax Relief Academy:

Your IRS Tax Resolution Survival System

This is a one-day, high-speed, zero-jargon system that equips you with the exact strategies and forms needed to resolve your IRS tax issues yourself, confidently, and without $10,000 in professional fees.

Self Tax Relief Framework™ - A taxpayer's guide,

developed from over 20+ years of IRS tax resolution experience.

Inside, you will learn to:

-

Decode Your Notices: What your IRS letters really mean and which deadlines you can't ignore.

-

Stop the Snowball: Implement strategies to halt penalties and interest growth ASAP.

-

Communicate with Authority: Know what to say (and what not to say) to the IRS confidently.

-

Choose Your Exit Plan: How to select the right relief option for your specific situation (Offer in Compromise, CNC, Installment Agreement, etc.) .

-

Get Resolution: Follow the step-by-step process so nothing slips through the cracks.

You get the same process tax attorneys charge thousands of dollars for. It's broken down into short, plain-English modules everyone will understand and you can even learn it all in a single day.

What You'll Learn Inside the Academy

-

Module 01 - Understanding the Tax Resolution Process

1 lesson- The IRS Tax Relief Process, Simplified

-

Module 02 - Defining Your IRS Problem

1 lesson- How the IRS Tax Resolution Programs Actually Work & Who Qualifies

-

Module 03 - Gathering & Documenting Your Financials

1 lesson- Gather the Documentation the IRS Will Ask For

-

Module 04 - Choosing and Executing a Resolution Strategy

1 lesson- What Steps Must Be Taken to Resolve Your IRS Tax Debt

-

Module 05 - Getting Help and Avoiding Future Problems

1 lesson- Where to Get Answers From: Trusted Sources, Professionals, and Organizations

Plus, These Bonuses to Make the Process Even Easier

IRS Problem Diagnosis Worksheet

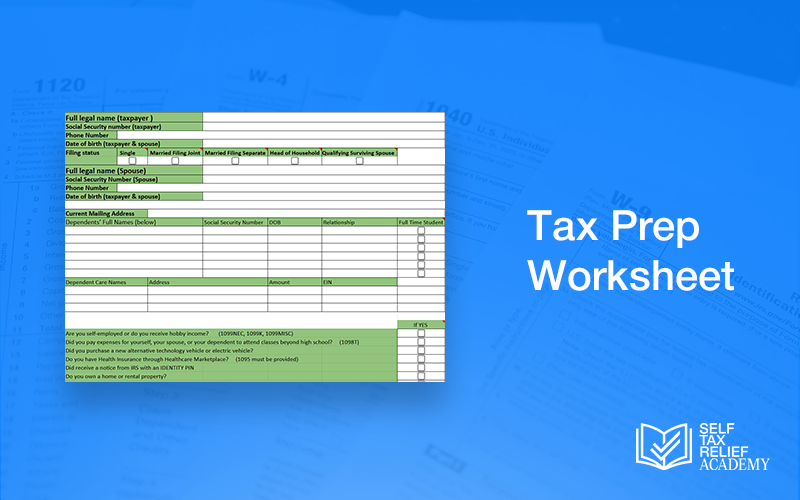

Tax Prep Worksheet

Disposable Income & IRA Calculator

Copies of necessary tax forms

Access to future updates

Why Choose Self Tax Relief Academy over a Firm?

Tax Attorney / Tax Firm

$1,500-$10,000

- Speed: They control how fast your case is worked & handled

- Knowledge: You remain ignorant of the process & options forever

- Control: They control everything about your case

Self Tax Relief Academy

$49

- Speed: You'll Learn the framework. You control how fast your case is worked

- Knowledge: You learn the IRS collection process. Lifetime Expertise

- Control: You manage your process. You are in control

Frequently Asked Questions

I have several years of back taxes, multiple notices, and potentially payroll issues. Is the Academy advanced enough for my situation?

"Tax attorneys" or resolution firms charge $1,500-$10,000. Your course is only a fraction of that, what am I missing? Is this knowledge really the same?

What if I make a mistake or miss a critical deadline by handling this myself? Isn't it safer to hire a professional?

Will I get myself into trouble by doing it myself?

Imagine Waking Up Tomorrow with a Plan.

The taxpayers who joined us were once overwhelmed and afraid. Just like you, they were received threatening notices and were nervous they'd make the wrong tax resolution decision. But the moment they saw the simple, clear steps of the Self Tax Relief Framework™, the fears vanished.

Like them, you’ll finally regain the peace of mind knowing you have:

-

A guaranteed plan of action.

-

Full understanding of your IRS resolution options.

- Confidence to handle IRS letters and notices.

- The power to protect your bank account and paychecks.

This knowledge is a lifetime asset. Don't let another day of uncertainty cost you time, money, or sleep.

Disclaimer: All materials, videos, downloads, and training provided within this course are intended for informational and educational use only. Nothing contained herein should be construed as legal, tax, or financial advice. No client–professional relationship is created by purchasing or viewing this course.